|

|

|

|

Five BigDent clients share their success stories!

Thriving businesses are feeding, educating families

|

|

Celestine has been in the microfinance program since 2009 and is currently paying back her sixth loan. Her first loan was about $112 for her sugar cane business. Her business has been steadily growing since then, and her current loan is for about $2,800. Celestine has never had trouble making her loan payments, and has substantial savings. Her three children are currently in college and she thanks God that she has been able to provide for her family’s needs throughout the years. Celestine’s goal is to open another branch of her business outside Bondeni to continue expanding her business.

|

|

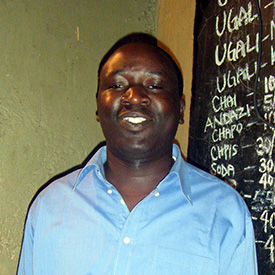

David Musa has received and paid off six loans since joining the microfinance program in 2009. He provides for his family by repairing cell phones and selling phone accessories in his community. His business has grown steadily, and he now operates from two locations with two staff members. As his business skills have grown, David has shown strong leadership skills in his accountability group as well as his business. He looks forward to the future when he can open more shops around his community.

|

|

|

A husband and father, Peter Njenge sells potatoes in his community in Huruma. Before he started this business he would sell things along the highway, but since his first loan he has been able to rent a shop in his own neighborhood. His business is thriving, which allows him to provide for his family. Peter has been able to enroll his children in good schools and now has access to better health care. He is looking forward to his next loan so he can continue to expand his business. A husband and father, Peter Njenge sells potatoes in his community in Huruma. Before he started this business he would sell things along the highway, but since his first loan he has been able to rent a shop in his own neighborhood. His business is thriving, which allows him to provide for his family. Peter has been able to enroll his children in good schools and now has access to better health care. He is looking forward to his next loan so he can continue to expand his business. |

|

|

Florence Kavisa has been a client of the microfinance department for the last four years. Her business is selling fruits and vegetables in her community. Over the last four years she has repaid three loans while remaining in good standing with Missions of Hope. Because her business continues to grow and generate more and more income, Florence has been able to pay her children’s school fees and ensure that they are getting a good education. One of her future goals is to generate enough profit to own her own shop instead of renting. She is so thankful for the help she has received from Missions of Hope and looks forward to growing and building her business in the future. |

|

When James Njoroge joined a microfinance group four years ago he didn’t even have a business! He began making and selling porridge in his community, and is now paying back his fifth loan. He has never defaulted on any of his payments. His business brings in a profit of about $20 a day, which he uses for his children’s school fees and providing other family needs. He plans to expand his business so he can begin building a rental house by 2018.

|

|

|

REACH intern makes microfinance his “cause”

|

|

When Ozark Christian College student Darrin Chitwood returned from his REACH internship in the Missions of Hope microfinance office in Nairobi, Kenya, he knew he wanted to do more for the folks he had come to know over the summer. When Ozark Christian College student Darrin Chitwood returned from his REACH internship in the Missions of Hope microfinance office in Nairobi, Kenya, he knew he wanted to do more for the folks he had come to know over the summer.

“They (the staff) taught me so much, gave up their time the whole summer to take me to visit accountability groups and teach me how microfinance works,” he said. “I truly just wanted to help out and give back because of their generosity and love toward me. When I asked what kinds of things would be helpful to the department, they mentioned laptops.”

Darrin went on to “Create a Cause” on the CMF website to raise $2,500 to buy five new laptops for the MOHI Business Development Services. |

|

| Would you like to join Darrin in helping new entrepreneurs get their businesses up and running so they can feed their families and send their children to school? Your gift of just $10 will go a long way toward empowering ministry in Kenya! Go here to donate. |

|

|

Numbers tell a story of hope

New clients increase by 40% this quarter.

|

|

Here is a statistical breakdown of activity in the third quarter of 2014 in BigDent:

|

|

TOTAL NUMBER OF WOMEN AND MEN HELPED TO DATE: 3,676

(8% increase from last quarter) |

| TOTAL NUMBER OF CLIENTS WITH LOANS OUTSTANDING: 1,007 |

|

NUMBER OF NEW CLIENTS THIS QUARTER: 279

(40% increase over last quarter) |

OUTSTANDING LOAN BALANCE:

$626,274 |

|

| NUMBER OF NEW LOANS THIS QUARTER: 153 |

| TOTAL AMOUNT OF FUNDS LOANED OUT THIS QUARTER: $223,081 |

|

| NUMBER OF CLIENTS TRAINED DURING THIS QUARTER: 200 |

|

NUMBER OF POTENTIAL CLIENTS CURRENTLY IN TRAINING MEETINGS: 353

(29% increase over last quarter) |

TOTAL NUMBER OF NEW ACCOUNTABILITY GROUPS: 10

(A total of 188 accountability groups now!) |

|

| TOTAL NUMBER OF LOAN OFFICERS: 8 |

| TOTAL AMOUNT OF MONEY SAVED BY CLIENTS YTD: $445,972 |

|

| NUMBER OF CLIENTS WAITING FOR SUBSEQUENT LOANS: 521 |

NUMBER OF CLIENTS WHO HAVE COMPLETED TRAINING AND AWAITING FIRST LOANS: 683

(23% increase over last quarter) |

|

| And finally, thanks to your gifts to BigDent, we now have 105 clients who reached the point of business sustainability this quarter and no longer need loans!

|

|

|

|

|

|